south dakota excise tax license

If you are not already using EPath to access your account create an account now. A Suppliers license is required if your business owns fuel within a pipeline system and can withdraw that fuel or authorize its withdrawal at a terminal located within South.

The South Dakota Contractor License Guide To Rules Requirements

The South Dakota Department of Revenue requires all contractors who enter into a contract for construction services to carry a South Dakota contractors excise tax license.

. Use their mailing address for this. ACH Debit or Credit. Who This Impacts Marketplace.

Sales and excise taxes are two separate taxes that many people pay attention to because they directly affect the price of. Contractors Excise Tax Laws Regulations. See the contractors excise tax guide for more information about laws and regulations.

All the documents you need to register fast. This application allows for the renewal of the following alcohol and lottery licenses. Mailing address and office location.

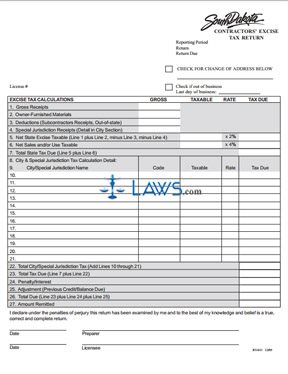

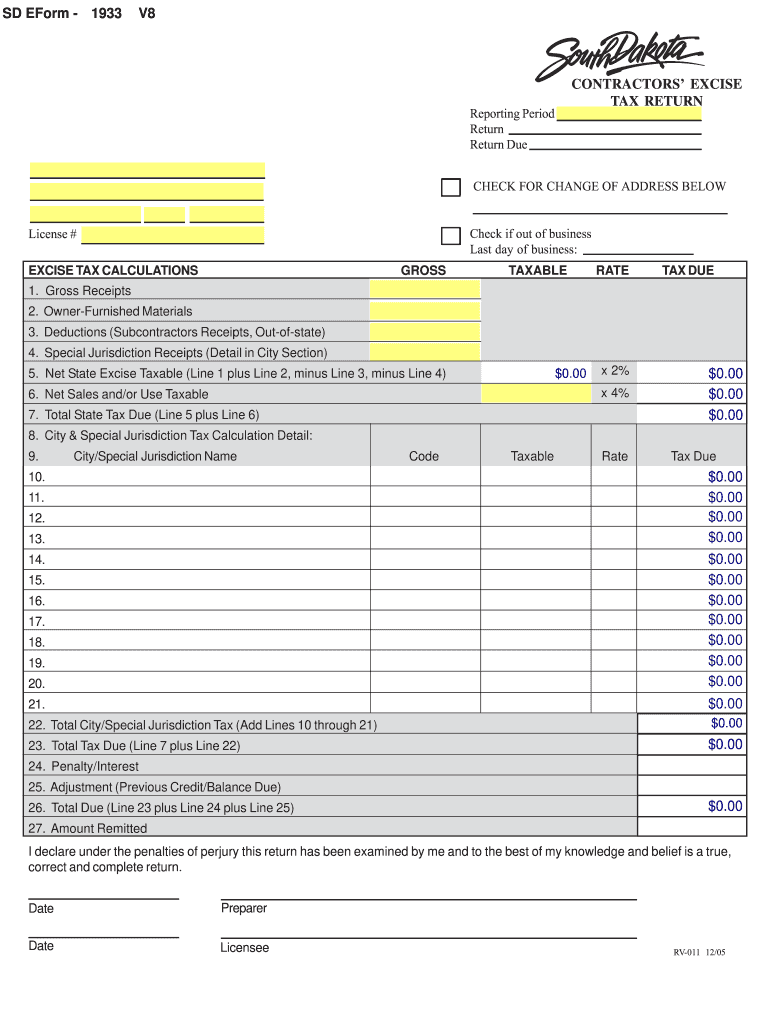

Total Tax Due Total tax due is calculated by adding Lines 7 and 22 PenaltyInterest Interest125 0125 of the tax liability each month or part thereof for a return filed or any tax unpaid after. Every contractor or personengaging in a business in this state whose receipts are subject to tax under this chapter shall file with the Department of Revenue an application for a. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Start a free online quote by just completing a. If you have any questions regarding the lottery please contact South Dakota. Make Checks Payable to.

Sales and Contractors Excise Tax License Application. Ment of Revenue Office or call 1-800-TAX-9188 or 605 773-7126 in the Pierre calling area. 10 10 of the tax liability minimum 1000 penalty even if no tax is due is assessed if a return is not received within 30 days following the month the return is due.

If you dont have an EPath account and need to make a payment by. South Dakota offers a reciprocity tax credit for title transfers or interstate titles in another state. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or.

Here you can find all the information necessary to start register and license a business in South Dakota. The price youll pay for your 25000 South Dakota Contractors Excise Tax License Bond is generally based on your personal credit score. 23rd highest cigarette tax.

Contractors Excise Tax Guide Laws Relating to. The South Dakota excise tax on cigarettes is 153 per 20 cigarettes higher then 54 of the other 50 states. Businesses who would like to.

As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one. South Dakotas excise tax on cigarettes is ranked 23.

Mobile Manufactured homes are subject to the 4 initial registration fee. You can email your questions to. Bustaxstatesdus or find us on the web at.

This is with the condition that at least 4 motor vehicles. Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations. Taxpayer Bill of Rights.

South Dakota License Plate License Plates In South Dakota Dakotapost

Sales Use Tax South Dakota Department Of Revenue

How To Register For A Sales Tax Permit In South Dakota Taxvalet

Form E0824 V4 Fillable Motor Fuel Tax License Application

How To File And Pay Sales Tax In South Dakota Taxvalet

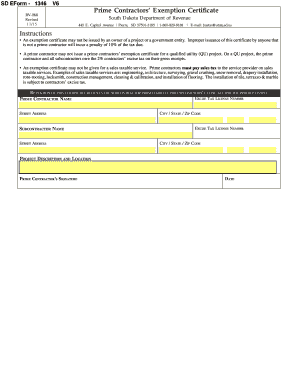

South Dakota Prime Contractors Exemption Certificate Fill Out And Sign Printable Pdf Template Signnow

Free Form 1933 Contractor Excise Tax Return Free Legal Forms Laws Com

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out Sign Online Dochub

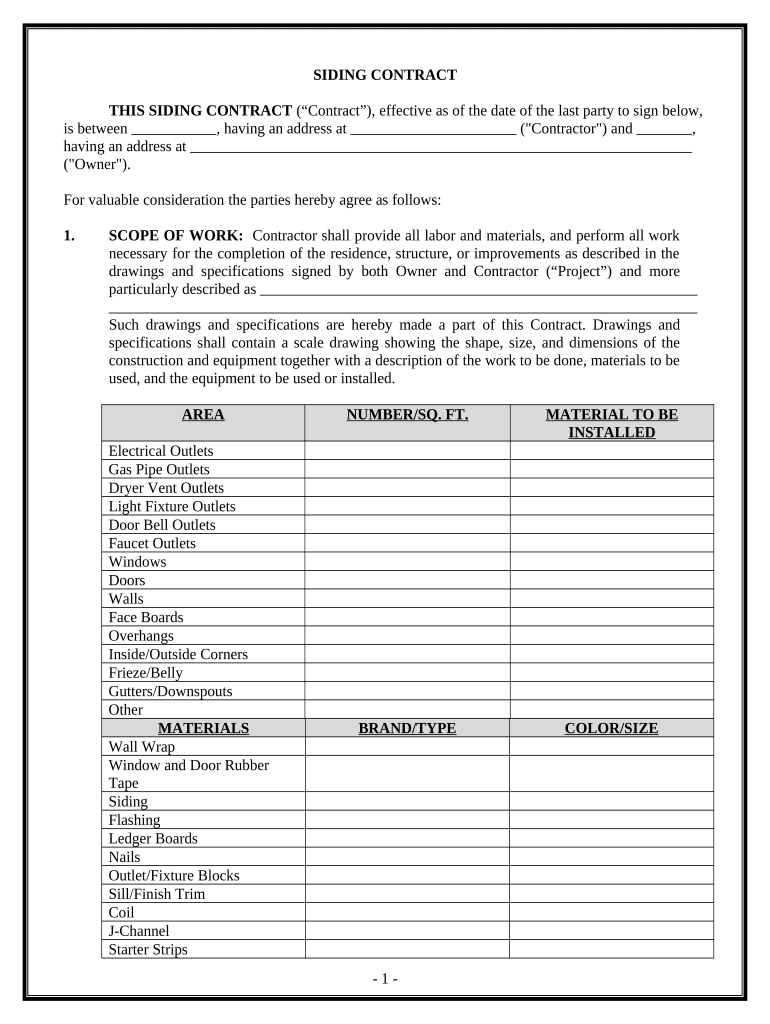

Siding Contract For Contractor South Dakota Fill Out Sign Online Dochub

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

Helpful Sd Fuel Tax Links Mflc

Excise Taxes Excise Tax Trends Tax Foundation

States With No Income Tax Explained Dakotapost

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

License Requirements For Sales Use Amp Contractors Excise Tax

Excise Tax Forms Reports Library Igen

Home South Dakota Department Of Revenue

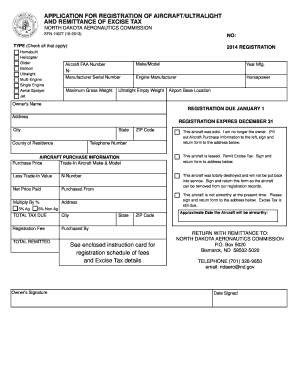

Fillable Online Nd Application For Registration Of Aircraftultralight And Remittance Of Excise Tax Nd Fax Email Print Pdffiller